Frequently Asked Questions Concerning Sinkholes

1.) If I am buying a home with a prior Sinkhole Claim, can it be insured? Yes. If the home has been repaired and Engineering Reports have been submitted to Insurance Underwriters a standard Home Insurance Policy is available.

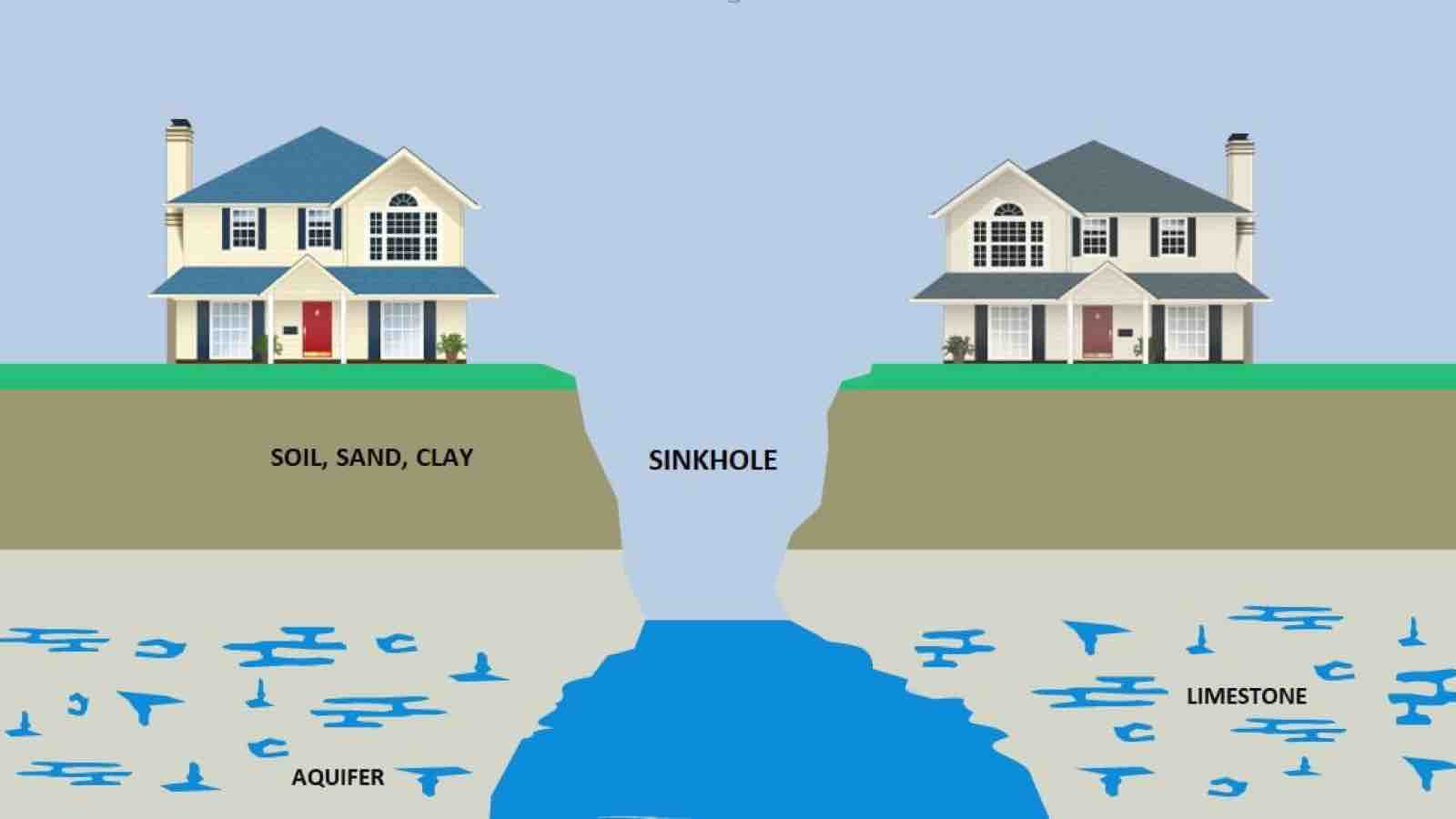

Definition:

(a) “Catastrophic ground cover collapse” means geological activity that results in all the following:

- The abrupt collapse of the ground cover;

- A depression in the ground cover clearly visible to the naked eye;

- Structural damage to the covered building, including the foundation; and

- The insured structure being condemned and ordered to be vacated by the governmental agency authorized by law to issue such an order for that structure (see the linked Florida Statue for more information).

2.) How do I make a claim? Call your Insurance agency/Insurance Carrier to file a claim.

3.) How soon will the carrier respond? Most Carriers will have a call line open 24/7.

4.) What information do I need to provide to the carrier? When the situation occurred and what happened.

5.) Who is involved in determining payouts? An Insurance adjuster will come out and assess damages. A contractor will also come out and estimate repairs/cost.

6.) When should I expect to get paid? In most cases 30 days with checks cut out to the homeowner.

How Loss Of Use Works In This Situation

If the home is uninhabitable the Insurance carrier will pay an amount to house the homeowner.

Rebuilding the home: According to the Florida Valued Policy Law- Dwelling (Coverage A): In the event of a total loss the Insurance carrier must pay to that limit.

For Example: It costs $300,000 to fix but the Dwelling (Coverage A) is at $500,000, the Insurance Carrier must pay the full amount of $500,000.

Additional Sites

Search for Sinkhole Permitting